Income tax and other compulsory payments

Individuals must pay tax on their income. Your tax on earned income (wages, salaries) goes

to:

• the State of Finland

• the district where you live

• the parish of your Church if you pay Church Tax

• Kela as a healthcare contribution

Capital income (example: dividends you receive). The taxes on capital income go to the State.

Not only individuals but also businesses must pay income tax!

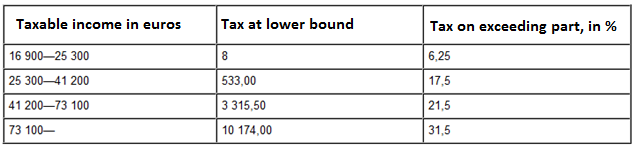

Evereone working in Finland needs a tax card, which will tell the employer how much should be withhold from the salary to the government. Income tax for the government is progressive and it is defined by the table (in 2017):

Table 1. Income tax scale in 2017.

Municipal tax is proportional, as it has the % for all payers. Municipal tax includes also different insurance payments and possible church tax.

Example 1.

A person earns 5800 euros in a month. Progressive tax based on tax card, emloyee pension insurance 6.15% (employer's part in 2017), trade union fee of 1%, and unemployment insurance 1.6% must be withhold from it. How much does the person actually get, if the tax card informs the tax deduction to be 35%?

All compulsory fees are fro the brutto salary. The remaining part is , so the person earns in netto per month.

Example 2.

How much does this person pay income tax by the Table 1, if there is no deductions at all?

Brutto income per a year is . According to Table 1, the progressive income tax with 69600€ is