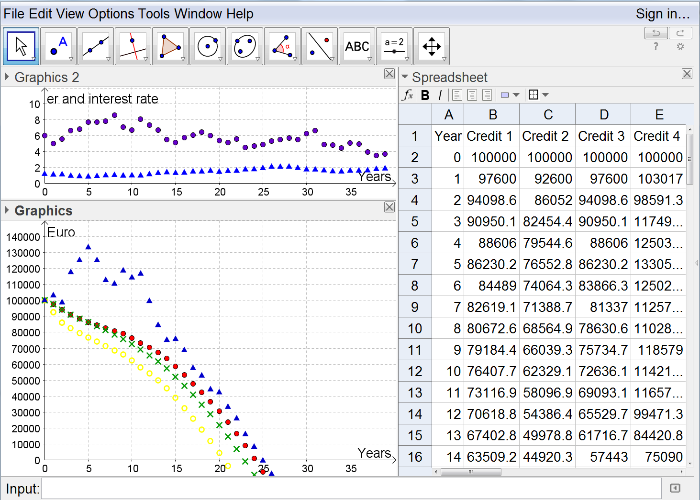

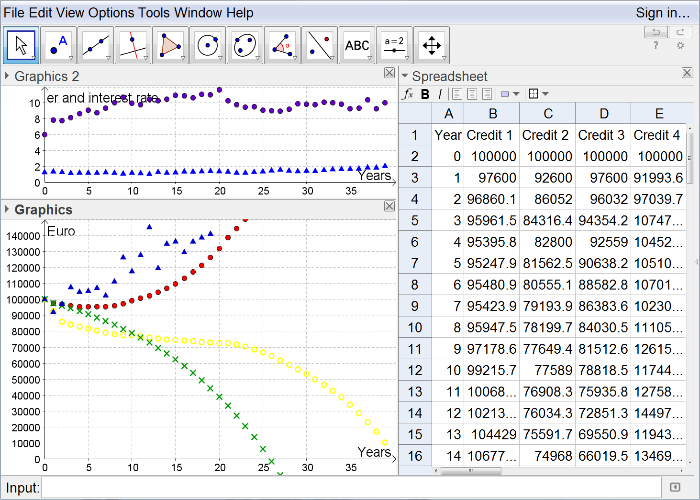

Random exchange rate and random interest rate

Unfortunately, one can't predict all these influences. Hence, we assume the key interest

rate as a sequence, like the exchange rate before. We start at p0 = 7 and define pn+1 = pn+X, where X is a random variable with distribution N(0; 0.42). We choose the

values p0 and , such that pn hardly takes negative values. For more realistic demands

one has to be careful to avoid negative values strictly. Furthermore realistic values are

currently very small, therefore some visual effects don't emerge. Nevertheless, we develop

further the GeoGebra applet and get the following:

Figure 4.1

Figure 4.2

Now there are many possible scenarios, two possibilities are shown in

figure 4.

Again pupils shall make some observations with focus on e.g. "What is the difference

between the debt level pathways of credit 1, 2, 3 and the debt level pathway of credit

4?" or "What happens to the debt level pathway if the key interest rate increases?" or

"In which sense is it wise to raise credit 3?"