Random exchange rate

We improve our model, at

first we neglect the assumption about the constant exchange

rate. Now the exchange rate (er)n1 is a certain sequence. We start at time zero with

er0 = 1.2 and for the further periods we have ern+1 = ern+X, where X is a random vari-

able with distribution N(0; 0,12) (In case of having not mentioned normal distribution

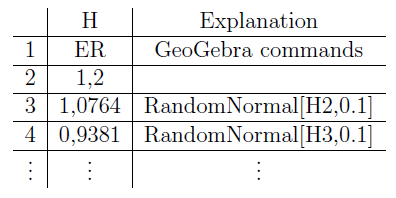

in class, one can use an equally distributed random variable instead). In the created Ge-

oGebra applet we slightly drop the slider bar about the exchange rate and construct the

mentioned sequence in the spreadsheet view, see Table 2. Furthermore we must change

the exchange rate er in column E and F according to random numbers in column H, e.g.

the command in cell F2 changes to "=E2*H2" and in F3 to "=F2*(1+p/100)-8 400*H3"

Table 2

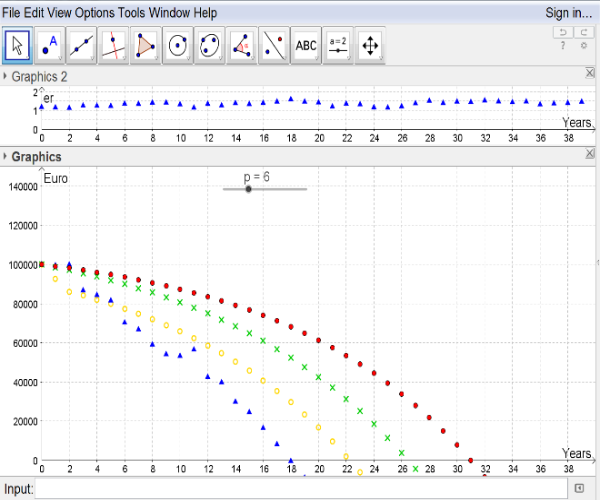

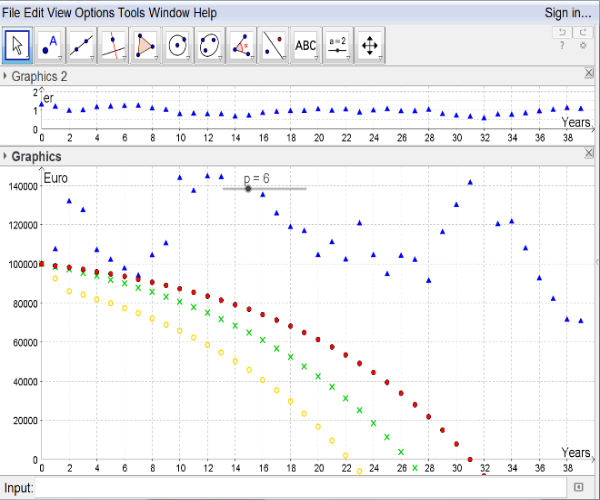

We visualize the exchange rate sequence by small triangles in the view of graphics 2. The

pathways of the debt levels of the other credits are presented as before, see Figure 3.

Figure 3.1

Figure 3.2

The creation of new scenarios easily happens by pressing the button F9 on the keyboard.

After creating this applet we are again in the stage of experiments in school. Guiding

questions, like "Which exchange rate paths are advantageous for the borrower (and which

aren't)?" lead pupils to the main focus.

Some coherences can be observed easily. A raise of the exchange rate is in favour of the

debtor (see left

gure 3) whereas a decrease of the exchange rate disadvantages the credit

user (see right

gure 3). Actually these heuristic observations require a proof.

A validation of the model above leads us to the point that the key interest rate can't

be constant over time. Its variations are the typical main source of the risk of a credit.

Again we try to model such an interest rate. The dilemma of raising a credit is the

variation of the key interest rate. One only knows the value of the interest rate for a

short term, here for the next year, in reality for the next three months. Then many

things affect the value of the key interest rate, like political, economic decisions and even

environmental happenings.